I am convinced that the recent correction in the Comex Gold price is about over. Since my call of a triple bottom in gold on November 8, 2022 (All is Golden) and jumping back into gold stocks, the up trend remains intact (blue lines).

Since then, the 100-day moving average has also acted as support, and we have now witnessed a few bounces off the US$1940 area. Other positive technicals are the CCI indicator that dropped into the red like previous correction bottoms, and although the RSI did not drop as far, it was significant. I see resistance just above US$1980 and ultimately US$2070 area, the all-time high.

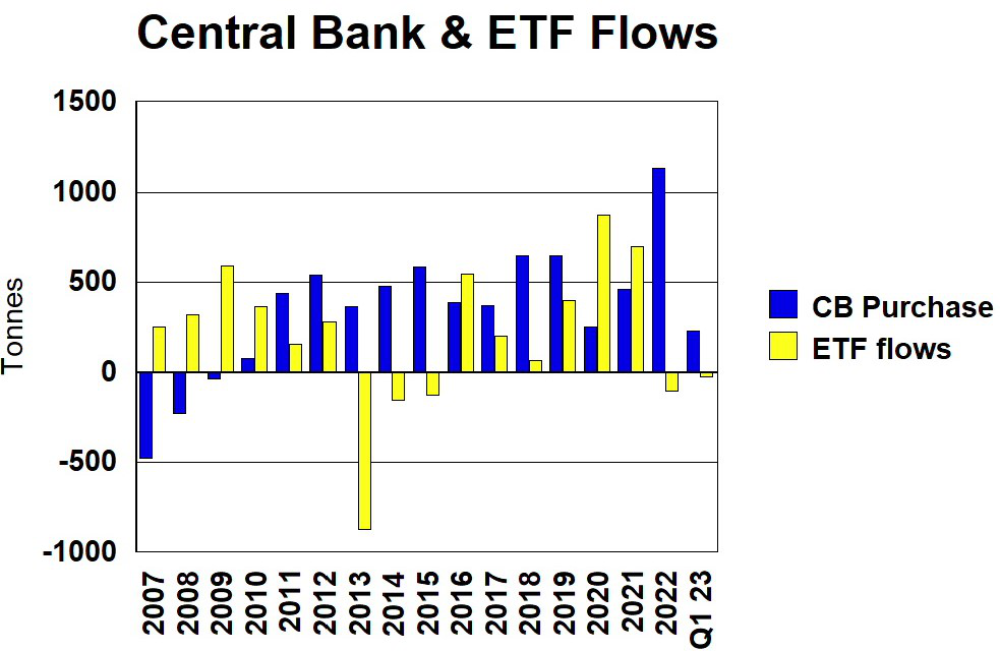

On the fundamental side, strong Central Bank buying in the physical market underpins the Comex paper market. Central banks alone have bought 228 tonnes from January through April, according to the latest World Gold Council report.

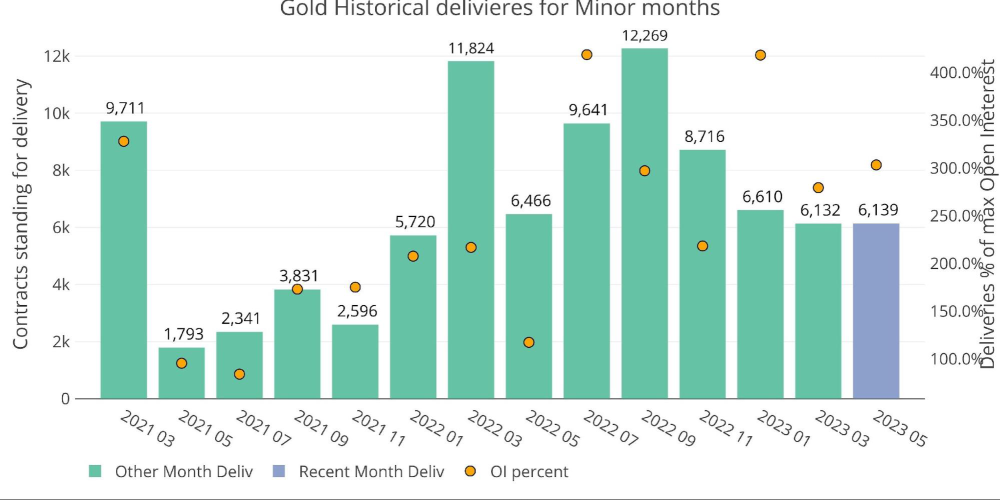

Anytime the price drops on Comex, more physical deliveries are requested. In general, you can see below in this chart from Schiffgold that Comex deliveries have increased since 2022. US$1.2B of gold was delivered in May. This is the second largest May on record, trailing only May 2020 during the storm of the pandemic.

China is Building a War Chest of Gold

China increased its gold reserves for a seventh straight month, among strong demand for the precious metal from the world's central banks. China raised its gold holdings by about 16 tons in May, according to data from the People's Bank of China on Wednesday. On April 16, Reuters reported that China had given domestic and international banks permission to import large amounts of gold into the country.

In November, Chinese President Xi Jinping told the People's Liberation Army to "focus all its energy on fighting" in preparation for war. U.S. military personnel have confirmed China is preparing for war to annex Taiwan but have not given a time frame. China's behavior is like Russia's before the invasion of Ukraine.

Before invading Ukraine, Russia de-dollarized its economy and stockpiled gold and Chinese Yuan. China closely watched the sanctions and the world's reaction to Russia's invasion. China has been negotiating trade agreements outside the Dollar and stockpiling gold. China may be planning an attack against Taiwan sooner than most imagine.

This is not getting any coverage in legacy media yet, but the Peoples Bank of China announced changes about three weeks ago to incentive its citizens to buy gold. The commercial banks in China created the ability for Renminbi savings accounts to be connected to gold accounts so that Chinese citizens can now buy gold directly out of those savings accounts. I believe you will see an even faster drawdown of Western gold as it gets bought in the east from China and other central banks as well.

China did a similar thing back in 2010, and at that time, it underpinned the gold price, and this will/is happening again. As their citizens buy gold, they want to see that investment rises in value for them. China knows all too well how the US$ can be weaponized against them, and they are preparing for that day. When the time comes, China will back the Renminbi with physical gold and reveal the whole extent of its gold reserves, as many are off the books at their reserve banks.

World Gold Council reports Central bank demand hit 228t in Q1, 34% higher than the previous Q1 record, set in 2013. And it is not just China, as India's official gold reserves are up from 17.9 million troy ounces in December 2017 to 25.55 million troy ounces in April this year, according to the latest RBI data. This roughly translates to 795 metric tonnes of gold. The Monetary Authority of Singapore (MAS) was the largest single buyer during the quarter.

Central Bank buying has been strong for over ten years, and it went into overdrive in 2022, and with Q1 2023 this pace looks to continue. You may also notice that ETF flow remains weak, slightly negative. It is only a matter of time before funds, and retail get on board.

Many may not realize that just five months ago, gold became a Tier 1 asset class worldwide for banks, making it equivalent to cash. Gold has zero counterparty risk, so banks may realize that it is better than fiat-based assets on their balance sheets.

Now, the Fed is the only remaining central bank net short gold. It looks to me like a last-ditch effort to keep the US$ value up relative to gold as most of the Eastern world is moving away from the US$. They see how it can be used against them, as in Russia's case.

Conclusion

I believe the strong Central Bank buying of physical gold will underpin prices higher on the Comex paper market. As the physical market gets tighter and tighter, it is only a matter of time before the Comex breaks out to record prices.

Once this happens, I see US$2,500 as a likely target, and the move towards this will bring in strong fund and retail buying that will also move silver higher and the precious metal equities. Currently, there are very low premiums on gold stocks call options, reflecting how out of favor the sector is. Here is a handful of Call Options I like.

Gold Stock Call Options

Kinross Gold Corp. (K:TSX; KGC:NYSE), CA$6.50 — The January 2024 CA$5. Call about CA$1.10; it is CA$0.50 in the money.

On the U.S. side, KGC — The US$5 Call option for about US$0.60

Equinox Gold Corp. (EQX:TSX; EQX:NYSE.A), CA$6.25 — The December 2023 CA$6. Call about CA$1.05

On the U.S. side, EQX — The January 2024 US$5. Call is about US$0.75.

Centerra Gold Inc. (CG:TSX; CADGF:OTCPK), CA$8.10 — The December CA$8.00 Call about CA$1.00.

On the U.S. side, CGAU — The January US$5 Call is about US$1.45, and it is about US$1.00 in the money.

SSR Mining Inc. (SSRM:NASDAQ), CA$18.75 — The March 2024 CA$20 Call about CA$2.00. It is out of the money some, but the stock is down from a CA$23 high, so it can easily get back there and more with higher gold.

On the U.S. side, SSRM — The January US$15. Call is about US$1.30.

And for silver, First Majestic Silver Corp. (FR:TSX; AG:NYSE; FMV:FSE), CA$7,50 — The December 2023 CA$7,50 Call about CA$1.10.

On the U.S. side, AG US$5.65 — The January 2024 US$5. Call is about US$1.30, so it is about US$0.65 in the money.

| Want to be the first to know about interesting Gold investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Equinox Gold Corp. and First Majestic Silver Corp.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Struthers Stock Reports Disclosures

All forecasts and recommendations are based on opinion. Markets change direction with consensus beliefs, which may change at any time and without notice. The author/publisher of this publication has taken every precaution to provide the most accurate information possible. The information & data were obtained from sources believed to be reliable, but because the information & data source are beyond the author's control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Because of the ever-changing nature of information & statistics the author/publisher strongly encourages the reader to communicate directly with the company and/or with their personal investment adviser to obtain up to date information. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise. Neither the information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. The author/publisher of this letter is not a qualified financial adviser & is not acting as such in this publication.